During our annual National Commercial Real Estate Brokerage Survey earlier this year, we asked “The Ultimate Question”, which is also the title of Fred Reichheld’s Wall Street Journal bestselling book. This book, a required reading for any owner or manager, dissects the loyalty of your people and your customers.

[Tweet “@FredReichheld’s WSJ bestseller “The Ultimate Question” is a must read for any #CRE owner or manager”]

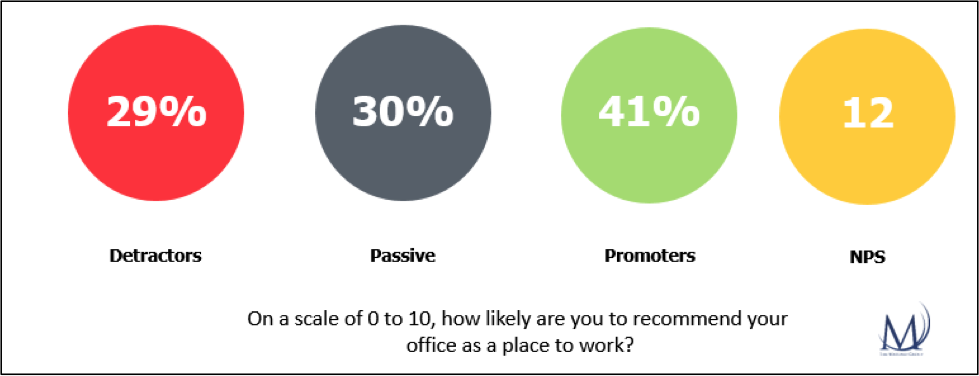

The “Ultimate Question” is How likely is it you will recommend us to a friend? With zero (0) being Not at All Likely and ten (10) being Extremely likely; and the accompanying result in a “Net Promoter Score”. This score is calculated by subtracting the number of “detractors” – those who answered the ultimate question with a rating of 0 to 6, from the “promoters” – those who answered the ultimate question with a rating of 9 or 10. Anyone who answered the question with a 7 or 8 rating is termed “passive”

In his book, Reichheld demonstrates the “fundamental concept of Net Promoter, explaining its connection to a company’s growth and sustained success and presents the closed-loop feedback process and demonstrates its power to energize employees and delight customers.”

[Tweet “The concept of Net Promoter has a direct connection to the growth and success of a company”]

As the consulting conglomerate Bain and Company explains, “The average firm sputters along at an NPS efficiency of only 5 percent to 10 percent. In other words, promoters barely outnumber detractors. Many firms—and some entire industries—have negative Net Promoter Scores, which means that they are creating more detractors than promoters day in and day out. These abysmal Net Promoter Scores explain why so many companies can’t deliver profitable, sustainable growth, no matter how aggressively they spend to acquire new business. Companies with the most efficient growth engines—companies such as Amazon, Rackspace, TD Bank, Harley-Davidson, Charles Schwab, Zappos, Costco, Vanguard, and Dell—operate at NPS efficiency ratings of 50 percent to 80 percent. So even they have room for improvement.”

So what about commercial real estate brokerage?

Do individual commercial real estate firms have different NPS ratings? Based on our survey, absolutely. However, for purposes of this blog, I will focus on the industry as a whole, and from the brokers’ perspective. This is an important distinction. This following reflects the opinions of the brokers themselves regarding the company they work with.

When asked the question “How likely are you to recommend your CRE company as a place to work?” Commercial brokers answered with “passive positivity” with a resulting NPS rating of 12. Just over 41% were raving fans or promoters. Slightly less than 30% were detractors.

[Tweet “Check out these interesting NPS stats from @MassimoGroup’s annual National CRE Brokerage Survey”]

Here’s a deeper look at this “Ultimate Question” in regards to those commercial real estate professionals responding

- The NPS increased as the tenure of the broker increased. In fact, the NPS for the same question, as answered by those with 16 years or more experience was 28. Those with less than 7 years of experience resulted in an NPS rating of 1. This suggests brokerage owners and managers may wish to focus on this segment.

- Those focusing exclusively on sales responded with an NPS rating of 3, compared to those who focused exclusively on leasing, who responded with an NPS rating of 11.

- Those working in primary markets reflected an NPS rating of 8; less than half the NPS rating, 17, of their peers located in secondary markets.

- The higher the commissions earned, the higher a NPS rating provided. Those earning less than $100,000 gross commission income resulted in an NPS rating of -1, while those earning between $750,000 and $1.5M responded with a NPS rating of 57.

Why is NPS critical to commercial real estate brokerage owners and managers? It directly reflects the loyalty of your most important assets – your brokers.

[Tweet “The Net Promoter Score directly reflects the loyalty of your most important assets – your brokers.”]

Note: Separate NPS ratings where calculated for each commercial real estate organization; however, we determined not to publish these publically at this time.

What do you think about the NPS ratings? Let us know in the comments below what you would like to see your firm provide to increase your likelihood of recommending them.