As my dear friend Jerry Anderson, CCIM would say – it’s time to “Lift Your Head Up!” There are changes happening in the market today that will impact those that are not paying attention, and the impact will be similar to King Kong stomping through New York.

[Tweet “”Lift your head up!” There are changes happening in the market today that will impact those that aren’t paying attention.”]

During our annual National Commercial Real Estate Brokerage Survey, 55% of the respondents felt their market was going to either be the same, if not better, in 2016 than in 2015. However, a resounding 80% felt their earnings would increase in 2016, and only 5% felt their earnings would be worse.

I am the first one to shout from the rooftops that individual earnings, if your business is positioned correctly, should not be predicated on market conditions; however, the vast majority of brokers do not position themselves correctly. Thus, market shifts will impact earnings. And in this case, the impact, for those not prepared, will be a negative one.

[Tweet “Business earnings should NOT be predicted on market conditions.”]

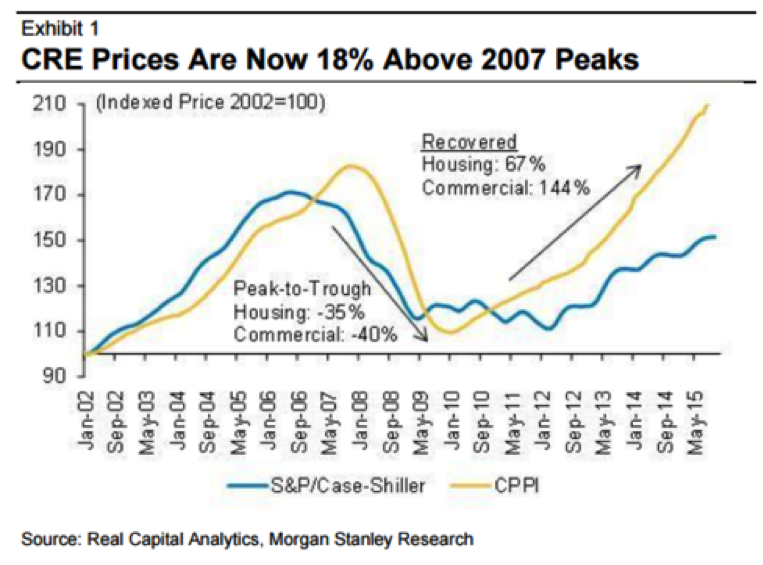

This past week Forbes reported that “Morgan Stanley analysts predicted U.S. commercial real estate prices would grow by a big fat zero percent in 2016, replacing a previous forecast of 5 percent growth over the course of the year.”

Also this week, in a separate article, Neil Howe of Forbes writes about “The Reality of the Commercial Real Estate Boom”, which I would highly recommend for anyone working in the commercial real estate arena. Mr. Howe addresses the non-urban markets beginning to feel the impact of a millennial migration to urban markets. Yes, it’s once again cool to live, work and play in the same community. These factors, although not immediate, will influence the deal velocity that the vast majority brokers are expecting.

[Tweet “Are you adapting to the changing market to attain or retain a dominant market position?”]

When the market is hot, deals are rampant and most commercial real estate professionals can find a deal. When the market starts to shift, it is ultimately those brokers who adapt that ultimately attain or retain their dominant market position.

If you are open to change and are willing to change, we would love to talk with you. You can schedule a free consulting call with one of our team members here.

One Response

I had the benefit on Tuesday to participate on the Investment Outlook 2016 Panel at the Interface Net Lease West Conference. Participants: Gordon Whiting of Angelo, Gordon; & Co. Gino Sabatino of WP Carey; Mary Fedewa of Store Capital, all majors figures in NNN world (and me). It was interesting to have our distinguished moderator, Maurice Nieman of CBRE state that tracking 71 recent pricing adjustments since January 1, (60 days +/-) that prices were reduced across the Board with deal volumes going down. I spoke up and stated that while I agree with the aggregate assertion of price reductions that cap rates moving from super aggressive sub-5% cap to somewhat less aggressive 5.0% cap is simply an adjustment from ‘crazy’ low cap rates to ‘less crazy’ cap rates. This is particularly true when the spreads for achievable debt solutions, even at lower coupon rate debt and lower LTV…..still a tough sell, in our humble opinion, based on the acute market intel that our proprietary 70,000 NNN property base informs our Clients and our Team. Acute market intel distinguishes ‘NNN wheat from NNN chaff”.